JD Edwards ’17 Survey Results

Serving as an unbiased benchmark for the JD Edwards community since 2002

Surety Systems developed the JD Edwards Survey to take the pulse of the industry each year. It allows you to see how you stack up to other JD Edwards users and is meant to serve as a benchmark for the community as a whole.

The 2017 survey reports the result of over 440 JD Edwards users. Data was collected in March of 2017. The survey was open to all participants through our website and we encouraged participation through email and social media.

Please Note: All numbers in the graphs below represent in percentages.

Demographics

A look at those who participated in this year’s survey. All participants live and work in the US for companies using JD Edwards.

Company Size

Less than 1,000

1,000-5,000

5,000-10,000

10,000+

78% of participants worked at small to medium sized companies with under 5,000 employees.

78% of participants worked at small to medium sized companies with under 5,000 employees.

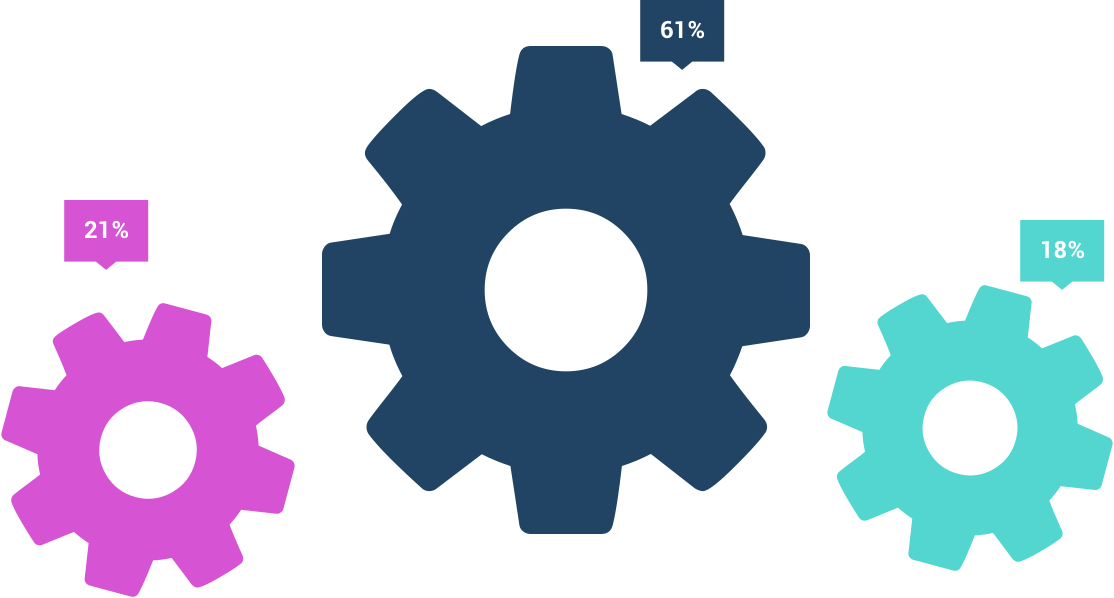

Roles

Management

Functional

Technical

61% of those who took our survey this year were in management roles.

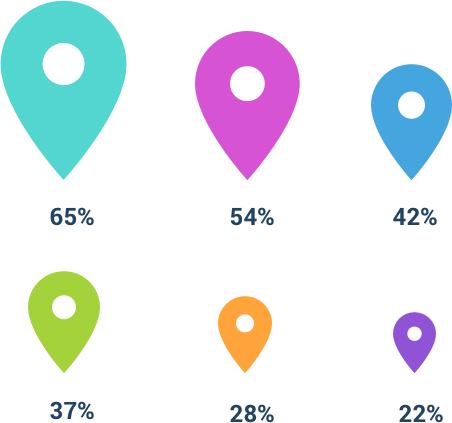

Verticals

Manufacturing

Distribution

Construction

Government

Real Estate Management

Other

The majority were in manufacturing, with additional participants in 9 other industries.

The majority were in manufacturing, with additional participants in 9 other industries.

A Fair Representation of the JDE Community

Overall, our survey participants seem to be a fair representation of the greater JD Edwards community. Our results this year provide a realistic picture of the present-day marketplace. When compared to results from previous years, it allows us to look for industry trends.

JD Edwards Setup

How does your JD Edwards Setup compare to others in the industry?

EnterpriseOne versus World

EnterpriseOne

World

EnterpriseOne adoption continues to expand, while World usage has seen a decrease over last year’s results.

EnterpriseOne adoption continues to expand, while World usage has seen a decrease over last year’s results.

EnterpriseOne Versions

| XE | 8.11 | 8.12 | 9.0 | 9.1 | 9.2 |

The majority of E1 users have upgraded “to the 9’s” as a result of a culture shift toward being code current

World Versions

| A7.3 | A8.1 | A9.2 | A9.3 | A9.4 |

While 9.3 gained traction quickly after it’s release in 2012, 9.4 has had a slower start.

World Users Slower to Upgrade than Those on EnterpriseOne

Organizations using EnterpriseOne have continued to heed Oracle’s call to upgrade to versions 9.0 or higher, with a significant increase in the number of respondents on v. 9.2 (up to 18% this year versus just 5% last year ). By comparison, we’ve seen a small increase in the number of users on version A9.3 (from 38% last year to 44% this year), but the shift has remained subtle.

Upgrade Timing and Approach

Most companies are conservative when it comes to upgrades, but E1 customers are still much more likely to upgrade than World users.

Approach to upgrades

80% of survey respondents indicated that their companies tend to be conservative when it comes to upgrades.

We tend to be early adopters

We typically wait for Oracle to work out bug issues, and then plan our upgrade

Our strategy is to stay 1 release behind the most recent release

We are happy with our current version and have no plans to upgrade anytime soon

EnterpriseOne

How likely are you to upgrade to Version 9.2 in the next 12-18 months?

Likely or Extremely Likely

Neutral

Unlikely or Extremely Unlikely

World

Does your organization have plans to upgrade to Version A9.4 in the next 12-18 months?

No

I don’t know

Yes

EnterpriseOne Customers Much More Likely to Upgrade than World Counterparts

This year, over half of companies running EnterpriseOne are planning to upgrade over the next 12-18 months. This number presents a strong contrast against the 16% group of customers that plan to upgrade their World systems.

Community Education

Top ways to stay informed about JD Edwards.

What

What formats do you prefer when learning about JDE?

Webinars

Case Studies and Whitepapers

Q&As/Interviews

Opinion Blogs

Press Releases

Where

Where do you go to learn more about JDE?

JDETips.com

QuestDirect.org

Special Interest Groups

Resource Utilization Groups

LearnJDE.com

Social Media (LinkedIn / Twitter)

Quest Participation

Comparing company participation to individual participation in the Quest community.

Company Involvement

Involved in the past but not now

Not involved at all currently

Somewhat involved

Very involved

More than half of the companies surveyed are actively involved.

Personal Involvement

Involved in the past but not now

Not involved at all currently

Somewhat involved

Very involved

Individuals were almost evenly split when it came to active involvement.

Quest Involvement

Company

Personal

Involvement in the Quest community remains strong.

Involvement in the Quest community remains strong.

New JD Edwards Technology

A look at adoption rates of emerging technology.

Mobile

Mobile usage

Is your organization taking advantage of Oracle’s Mobile Apps functionality?

Mobile adoption

Mobile Application adoption trend for ERP.

Mobile Adoption is Waning

While mobile adoption has climbed steadily since we began tracking this metric in 2010 , this year we saw adoption rates reach a plateau at 11%. This is likely due to a combination of concerns about data security, costs of implementation, and user adoption, combined with lack of internal knowledge about possible usage and best practices.

Cloud

IT Cloud versus Oracle Cloud

70% of companies are using cloud in some way.

| Yes | No |

70% of companies are using cloud in some way.

Cloud Utilization

Cloud adoption is much more common in the core ERP functionalities.

Cloud adoption is much more common in the core ERP functionalities.

Cloud Strategy

How would you best describe your organization’s strategy regarding cloud moving forward?

100% Cloud-based

Not sure / Too early to tell

Hybrid

Cloud Outlook

How would you best describe your organization’s strategy outlook for Cloud over the next 2-3 years?

Unsure but leaning toward no

Not sure

Not at all

Hybrid

Fully Cloud

Cloud Concerns

What do you perceive to be the main factor keeping companies from cloud adoption?

Forecast for 2017 is Partly Cloudy

The majority (70%) of companies have adopted cloud in some form by this point — however only 28% of participants reported that their company has adopted Oracle’s Cloud. Instead, most companies are using cloud for HR and Sales functions — time and attendance, HR/Payroll, and Customer Relationship Management. Similarly, 66% of respondents said they foresee their company using a hybrid approach moving forward.

IoT

IoT

IoT Awareness

Are you familiar with the term “Internet of Things” (IoT) and how it applies to your organization?

Aware of what IoT is

Aware and knows how to leverage it

Actually utilizing it

JD Edwards Users Familiar with IoT

Almost all (83%) of our survey respondents were familiar with the term “Internet of Things,” although less than half (37%) were clear how it could be leveraged for their business. A surprisingly high number of those who responded that they were aware of how it could benefit their businesses are actually using it — almost a quarter of those surveyed indicated they are actively using IoT at their company.

Additional Technology Solutions

A look at what other technology solutions JD Edwards users have adopted.

HR Solutions

Which software package(s) does your company utilize for their HR/Payroll Functionality?

Tax Solutions

Which software application do you rely on for your Sales & Use tax functionality?

| Vertex | Avalara |

| JDE Tax | Other |

| One Source | I don’t know |

BI Solutions

Which software package(s) does your group use for Business Intelligence/Reporting?

JDE HR/Payroll, Vertex and BI Publisher Rank as Most Popular Solutions

Vertex remains the first choice for JD Edwards users with a 42% adoption rate when it comes to tax solutions, despite how hard it can sometimes be to implement correctly. JDE tax remains a strong second choice, at a 24% adoption rate. In the HR Solutions category, 36% users indicated their company makes use of the JDE HR/Payroll module, followed by ADP E-Time and Kronos with 20% and 18% usage rates respectively. This is consistent with what we found last year, despite including several additional options in our survey choices this year. By comparison, we saw usage of BI Publisher almost double from last year to this one, going from 24% in 2016 to 40% in 2017. JDE Financial Report Writer remained in second place, but also saw a significant increase in use, going from 16% in 2016 to 24% in 2017.

JD Edwards Outlook

A look at how survey participants and their organizations are feeling about JD Edwards in the years ahead.

World Outlook

What is your organization’s plan for your current World setup over the next 3-5 years?

Stay or Go

Each year since 2011, we asked World users if they plan to stay or go in the next 3-5 years. Stay on World, or Go (Migrate to EnterpriseOne or migrate to Another Non-JDE ERP).

Stay, Migrate or Leave

We then asked the same participants who stated they weren’t staying with World, whether they were planning to Migrate to EnterpriseOne or Leave JD Edwards for another ERP.

Stay on World Migrate to EnterpriseOne Another Non-JDE ERP

World Users are Considering Options

Companies currently using JD Edwards World are seriously considering other options — many are simply evaluating the move to EnterpriseOne, but a significant percentage are also evaluating other ERP systems. Only a relatively small percentage of those currently on World are planning to continue using it for the next 3 to 5 years.

Outlook for 2020-2022

Breakdown of this year’s outlook for the next 3-5 years for current World users. Planning to Stay, Migrate or Leave?

Stay on World

Migrate to E1

Another Non-JDE ERP

EnterpriseOne Outlook

What is your organization’s plan for your current EnterpriseOne setup over the next 3-5 years?

Stay on E1

Migrate to Another Non-JDE ERP

Not sure

Predictions for 2018 and Beyond

· Sustained EnterpriseOne 9.2 upgrades through mid-2018, then decline · Positive 3-5 year commitment response in 2018 / 2019 by 2020 EnterpriseOne is STRONG!

Overall Perceived Outlook

If you had to describe your thoughts on the future of JD Edwards in one word… what would it be?

Overall Outlook Positive

Overall users feel positive about the future of JD Edwards — while there are still some concerns about the push to the cloud, when asked to describe their outlook users choose largely positive words (“Solid,” “Bright,” “Stability,” “Long term,” etc).