Payroll is one of the most manually intensive business processes in any organization, and you’re guaranteed to find inefficiencies and errors in payroll data that will cost you plenty of time and money.

That’s why so many companies turn to Workday — the Workday payroll system solution that changes the process by improving efficiencies with continuous payroll calculations, smart payroll audits, retro payroll processing, employee self-serve functionalities, and more.

If you’re thinking about streamlining your complex payroll processes by implementing Workday Payroll, you’ve come to the right place.

What’s Included in the Workday Payroll System?

Here are the main features included in the Workday Payroll Management solution…

One-Stop Payroll Shop

Adding the Workday Payroll system to your overall Workday Human Capital Management or Financial System can help you maximize your investment with a single, cloud-based solution. The functionality built into both the Workday Human Capital Management (HCM) and Payroll systems helps align all the information you could need for payroll processes in a single place.

Whether you need to make changes to employee benefits, update financial information following terminations, or complete audits of general payroll information, Workday’s payroll software has all the features required to meet your payroll needs.

Allowing employees to have control over their own experience is an integral part of your team’s satisfaction, and, luckily for you, Workday understands this. Its employee self-service functionality lets users track and request payment information on any device, whenever they want and wherever they want.

Workday’s payroll functionality is more advanced than other legacy systems and has a high success rate in reducing payroll processing times (a whopping 85%) and increasing payroll accuracy. In addition to its speed and accuracy, Workday also allows your payroll processors to view important payroll information and flawlessly integrate it into the general ledger.

Functional Payroll System for Accurate Calculations

If you’re familiar with outdated payroll processing systems and software, then you’re probably thinking there’s no way for a single system to allow you to customize your payroll process to meet your business’s specific payroll needs. This is where Workday comes in.

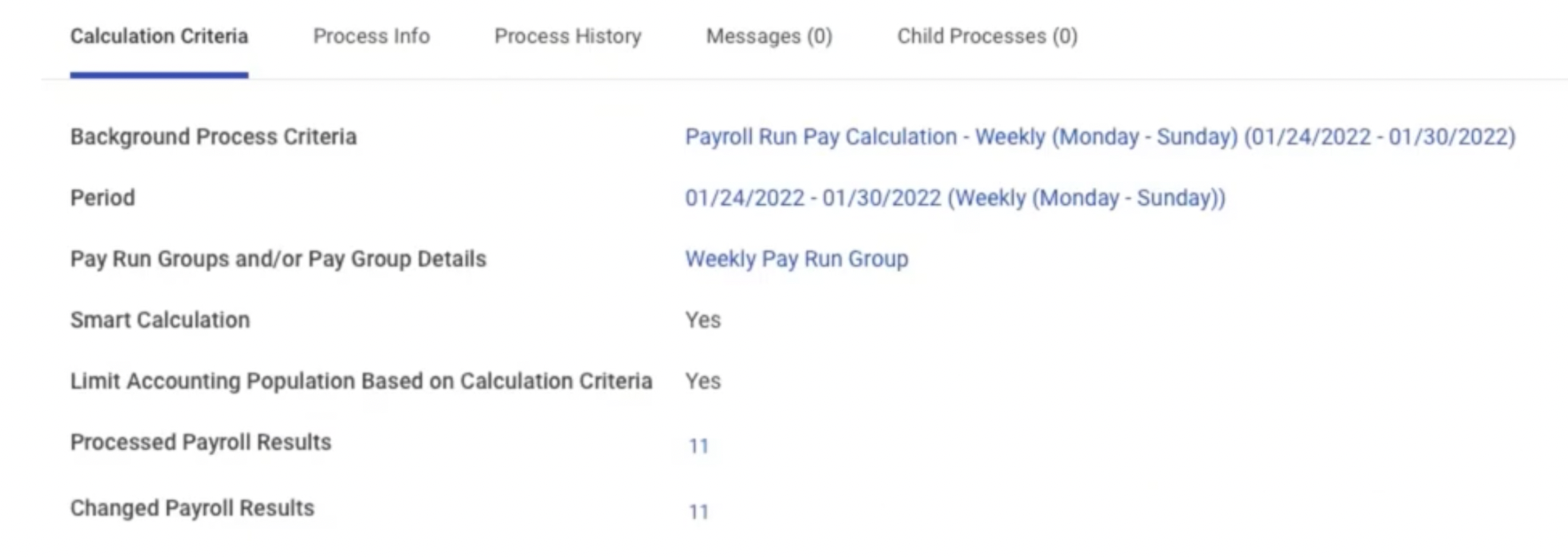

Workday’s payroll system is configured so it automatically updates payment changes and results, so your employees have up-to-date payroll information at their fingertips whenever they need it. The system also has a continuous processing capability that tracks real-time recalculations and events that could impact your employees’ pay cycle or pay calculation. This ensures that all employees are kept in the loop about their own payroll information so there are no surprises or added headaches.

Suppose higher calculation options and automatic tax updates aren’t enough to convince you of Workday’s payroll benefits. In that case, users also have the ability to choose multiple pay cycles or “runs” for different groups of employees. For example, suppose your manager and company executive salaries are paid monthly, but your hourly employees are paid bi-weekly. In that case, Workday allows you to keep your pay groups separate and run pay cycles according to employee status.

Improved Security Permissions

The Workday payroll system houses lots of important personal and financial information that top-notch security guidelines and permissions must accompany. Workday takes advantage of two groups to maintain proper payroll security: role- and segment-based groups.

Role-based groups are focused on an individual’s position rather than their department or individual user. These security assignments are constrained and must be assigned to each individual occupying certain positions to ensure proper access to secure data.

Segment-based groups involve higher levels of security and stricter permission requirements. Although they are still user-based, meaning individual permissions are still assigned to specific Workday users, the segmented groups limit access to segmented items in the system. The security requirements needed to access the segmented items allow for additional protection of important personal information so it doesn’t end up in the wrong hands.

Configuration Capabilities to Meet Your Needs

Everyone knows that trying to keep track of account balances and payment periods with an outdated system can be a real hassle. This is why Workday focuses its payroll services on increasing configuration capabilities to meet your payroll calculation or reporting needs.

The main benefit of better system configuration options for Workday users is the placement of employees into segmented pay groups. More necessary for larger organizations, these pay groups allow you to separate complex payroll functions by specific employee type, rather than spending unnecessary time and effort trying to run payroll the same way for all employees.

Separating employees into separate groups by employee type and pay cycles further enhances the functionality of your Workday system and gives administrators a more customized experience in the system.

Diverse Payment Options

Sometimes, pay periods don’t always align with our current financial needs. Workday recognizes that employees don’t always have the financial flexibility to wait for their next pay period to arrive. That’s why they offer Pay-On-Demand, a piece of the product that allows employees to request previously accumulated wages before their intended pay period.

But, it doesn’t stop there. Workday’s flexibility also gives users a choice in their payment and deduction options, offering them much-needed assistance in more trying times. By keeping all the payroll services in a centralized place, users can track payments, update deduction preferences, and build repayment plans at their own convenience.

While every implementation will follow Workday’s prescribed methodology, we do have a few insider tips and tricks from our trusted consultants to help make that process faster and smoother.

Here are some of their best tips and tricks.

Work Out Your Payroll Pain Points Before You Begin

When getting started with your Payroll implementation, Workday will ask you to fill out a massive workbook with details like earnings, deductions, taxes, special circumstances, and much more.

This workbook is the guide for how you plan to customize the software to meet the payroll needs of your individual organization. The workbook is also your opportunity to start fresh and put together payroll solutions that make sense for your organization as it is now, as well as how you expect it to be in the near future.

It’s a fact of life that companies grow and change over time, and systems can get messy as they try to adapt to changing circumstances. Those jury-rigged solutions might work, but they come with plenty of pain points. Keep those payroll pain points in mind as you fill out the Workday workbook so that you don’t end up copying over all your current issues into a new solution.

Focus on Functional Aspects

Knowledge transfer is critical when you’re implementing Workday Payroll. In most cases, you’re coming from legacy systems whose environment is very different from Workday, which is why we stress the need for functional training over technical training.

Your implementation consultants will take care of the technical side of things, but what are you going to do a month (or three months, or six months, etc.) after those teams have left? Some tasks in Workday can seem a bit like a scavenger hunt, and there are often several different ways to accomplish a given task. Take the time to learn how to navigate the ins and outs of Workday during your implementation so you can optimize your customer experience.

Additionally, we provide our clients with a functional checklist to make sure they have the confidence to functionally operate the system on their own once we’ve left the building. (We’re not going to throw you in the deep end and assume you know how to swim.)

Don’t Skimp on Testing

When you’re looking at a system that’s shiny and new, it can be easy to assume that the underlying configuration beneath that new user interface correctly suits all your needs. But a beautiful house can be built on shaky foundations. Don’t assume that a system that looks fine is fine. Test, test, test—it’s the most critical piece of implementation.

We always suggest putting your eyes on everything. Even when you’re checking your earnings, double-check things like takes. You want to make sure you’re checking absolutely everything.

Our best testing advice? Run at least two parallel payrolls before turning off your old platform; that way, you can double-check to ensure things haven’t totally gone off the rails.

Partner with an Expert Third-Party Consultant

Our final tip for Workday Payroll implementation success is to partner with an experienced Workday consultant who’s been through Workday payroll training and who really knows their stuff. And, to add the cherry on top, we’ve included a few of the added benefits our consultants can bring to your team…

Finding Issues and Fixing Them Fast

Consultants have seen a lot. (Like, think about how much you think “a lot” is, and then double it. That much.) They’ve worked on many different implementations with companies of various sizes in a wide range of industries. This varied experience gives them the insights necessary to ask out-of-the-box questions during implementation and spot the red flags that might pose problems for you along the way.

Because our consultants are familiar with various types of issues, having seen them before, they’re able to identify the trouble spots and fix them much faster.

Thinking Like a User

Many consultants have been in your shoes. Before consulting, they worked at a company that used Workday, which means the payroll team knew the ins and outs of the software as an everyday user. This experience makes it easier for them to keep the end user in mind and to spy gaps missing from a technical and/or functional perspective.

Far too often, payroll is somewhat of an afterthought when a company migrates to a new system. The truth is that there’s a lot involved in the process, and without an opportunity for employees to express what’s needed to make the system run smoothly for payroll, the implementation could get rocky.

Bringing Technological Expertise

One of the biggest benefits of having a consultant in your pocket is that they’re Workday product experts. Our consultants have advanced skills in handling every product and its advantages and setbacks. They can advise you on setting up payroll to make it more efficient and provide you with best practices to ensure you’re getting the most value out of this solution you’ve invested in.

How Can We Help?

From navigating the workbook to thoroughly testing your system for payroll data errors, our senior-level Workday consulting team has experience in every aspect of the Workday Payroll module.

Here’s an inside look at one of our Workday Payroll consultants to help you know what you’d be getting by partnering with us…

Surety Senior Workday Payroll Consultant

- 20+ years of Payroll experience, 7+ years specific to Workday Payroll

- Experience in processing payroll in post-go live

- Well-versed in Payroll post-production support

- Strong configuration ability within Workday Payroll

- Has served as Workday Payroll Lead on several projects

- Able to review current configuration/payroll processes and identify areas of opportunity for optimization efforts

Contact Us

We’re here to help your company, payroll team, and more understand how to use Workday Payroll to conduct your organization’s payroll process and reduce errors in payroll data, improve business processes, implement your new system, or offer a helping hand for whatever Workday needs you may have.

Contact us today to get started!