There are two ways to go about new business technology. The first is to latch onto each new technology that promises to make your business more efficient or effective—to listen to the salesperson’s pitch and buy every promise: hook, line, and sinker. This approach is probably aligned pretty closely with the reasons that 25% of technology projects are said to fail outright.

Fortunately, there’s a second approach: Find good tools and verify that they’re a good fit for your business. Determine a plan for implementing them successfully. Implement them. Enjoy the rewards.

Vertex and JD Edwards: What’s the Value?

Each year, hundreds of sales and use tax rates are updated or change throughout the United States. That’s why so many companies running JD Edwards have turned to Vertex software for tax compliance. According to the Oracle Help Center:

“Vertex software calculates the tax for customers and suppliers based on the GeoCode (U.S. Jurisdictions) and other special considerations, such as tax exempt status or non-standard tax rates. When tax laws change, the Vertex software accesses the new requirements for each taxing authority so that you can apply the taxes correctly.”

This software offers significant advantages compared to tracking tax law manually and trying to maintain your own database. After all, incorrectly paying taxes can lead to severe IRS penalties (as one of our clients found out the hard way, before bringing Surety onboard). But just because Vertex software offers real value, doesn’t mean it doesn’t still require careful planning to successfully implement — there are a number of common mistakes we see clients make again and again when it comes to Vertex and JDE.

Follow our tips below to avoid these common pitfalls at your company.

Choosing the Right Version of Vertex for JD Edwards

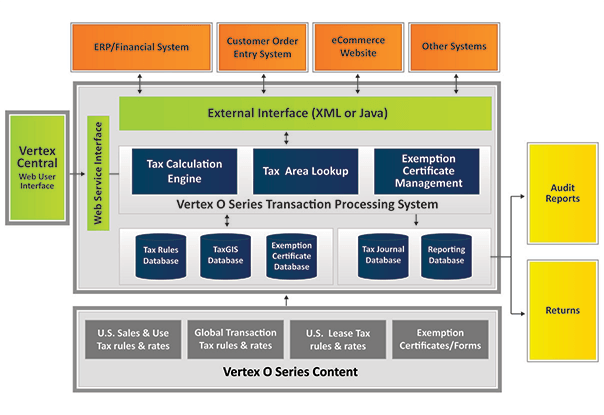

If debating adding Vertex to your JD Edwards system today, you could be forgiven for believing the best option was O Series. Since releasing it, Vertex has pushed it as their “leading solution” for automating and centralizing the indirect tax process. It offers integrations for SAP, Oracle, and more.

Vertex Indirect Tax O Series Architecture, via Vertex Inc.

But this is a case where it really makes sense to ask for references and carefully evaluate the option that’s right for your business. In our experience, for most JD Edwards customers, Q series is actually a much better fit. In the words of one of our consultants, “Integrating O Series with JDE is not impossible, but it is ugly.”

He shared his experience on two separate projects—the first had a third party developing the interface. The project started in May, with an August projected go-live. It finally went live in January of the next year. The second company brought in Vertex themselves to handle the integration; he said they took just as long to get the base integration in place and the two systems talking to each other. Why?

“Nobody has a repeatable solution, so every integration is custom and requires a lot of development,” he explains.

For that reason, he recommended to a client that they use Q Series instead; it would meet their requirements, and wouldn’t require any development.

Takeaway: Make sure you know what you’re getting before you pay for it. Ask for references and 3rd-party recommendations. If you can, get an insider’s perspective.

Ensure Tax Decision Maker (TDM) Tables are Configured Correctly

Of course, even the best software is only as good as its implementation. Configure the details wrong, and you’re just as likely to wind up on the wrong side of the IRS as if you hadn’t implemented the software at all. One of the most common problems we see with customers using JD Edwards and Vertex Tax Software is misconfiguration of the TDM.

There are seven TDM tables that you can set up in Vertex:

- Master Table (by state)

- GeoCode (by jurisdiction)

- Product Table (by state, by product category)

- Customer Table (by state, by customer)

- Location Table (for Colorado only)

- Override Subtable (by product, and/or customer, and/or jurisdiction)

- Exemption Subtable (by customer – exemption certificate)

Configure these incorrectly and the software won’t work in the ways you intend, which means it’s important to work with a Vertex expert when integrating the software with your JD Edwards system. Yet Vertex itself has a long wait list (one client was told they’d have to wait several months) and can be expensive, so many companies turn to third-party consultants who claim they can set up the integration. Unfortunately, not all of these companies have experts who have worked on both JD Edwards and Vertex before, as one of our clients found out the hard way.

A New England-based manufacturer of data acquisition systems required Vertex tax compliance software to meet the needs of its organization. After paying a third-party consulting firm to install Vertex, the customer found the software hadn’t been customized to meet its needs, and the software lacked the advanced functionality that the business required. Surety stepped in to provide a systematic review and upgrade to their Vertex software.

Takeaway: Careful Vertex vendor selection is just as essential as careful selection of the version of the software implemented, and organizations should apply the same advice: get references and recommendations.

Don’t Let Your Vertex Tax Compliance System Get Dated

As mentioned above, each year, hundreds of sales and use tax rates are updated or change throughout the United States. That means it’s critical to keep Vertex up to date to ensure continued tax compliance. However, updates are not applied automatically; they need to be manually applied. That means keeping someone in-house who understands how to properly oversee those upgrades, and install them correctly—and making sure there’s someone else who can step in when that core person is out on vacation or leaves the company.

Even though Vertex software is designed to be user-friendly and simple to operate, your team is likely to need some training on how to maintain it. Ensure your implementation vendor also provides knowledge transfer, so that your team can keep your system from becoming outdated. Otherwise, you may not even know you have a problem until you’re penalized by the IRS, as was the case with a machine tool manufacturing company we worked with that relied on Vertex for their business’ tax needs.

Takeaway: Ensure knowledge transfer during implementation that includes maintenance needs for the system.

Vertex and JD Edwards: Don’t Make These Mistakes

When integrating Vertex software and JD Edwards make sure you avoid the most common integration mistakes.

- Remember to validate that the version of Vertex software you’re buying is the right one for your organization—talk to customers who are using it in conjunction with JD Edwards, and do an in-depth analysis of your needs vs. the functionality available in the versions being considered.

- Be careful when selecting an implementation partner; ensure they have the experience and expertise to correctly integrate JDE and Vertex software and to configure it all correctly.

- Include knowledge transfer was part of your implementation project so that your in-house team can maintain your Vertex software correctly—or you may find the IRS knocking at your door.